Published on the 11/04/2016 | Written by Beverley Head

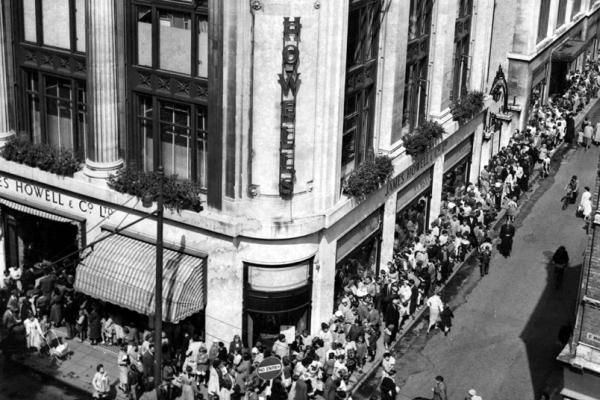

Anyone who has ever stood in a department store queue knows that stripping friction out of the retail process helps the consumer – but it turns out it also helps the retailer…

A survey of 1,000 Australians conducted by Commonwealth Bank has found that 50 per cent would leave the store if they had to queue for service. The survey found that inefficient customer service and queuing were two of the biggest no-nos for consumers and had a direct impact on sales.

Besides wanting friction-free service and payments, consumers are also warming to the idea of retailers using their personal information in order to offer a more bespoke service. Almost three quarters (74 per cent) said that they would be likely to remain loyal to a store offering more personalisation.

CBA’s survey, while interesting, does seem somewhat skewed toward acting as an endorsement for its Albert point of sale tablet device which can accept payments, but also provide retail insights to the shop assistant.

What it does make crystal clear however is the still slow adoption of digital wallets as a payment method in Australia. Just 6 per cent of the 1,000 survey respondents said that they had used a digital wallet (smartphone equipped with a payments app) to make a payment.

Whether the appetite for digital wallets changes if and when ApplePay becomes available to Australian consumers beyond those with an American Express card remains to be seen.

At present the debit and credit card remain much more popular, with 75 per cent of respondents citing these as the primary form of payment. Around half of the respondents used tap-and-go to make payments in store.

That makes Square’s decision not to launch its tap and go payments system in Australia appear a little perverse. After setting up operations in Australia last year, the company launched its $19 Square card reader that turns a smartphone into a point of sale device, in March. Charging a 1.9 per cent commission on transactions, it hasn’t offered Australian retailers its tap-and-go reader however, though the local device has been optimised for Australia’s chip and PIN debit and credit cards.

The rise of payment FinTechs such as Square and PayPal, has opened up a much broader range of point of sale options for retailers and merchants. But the more entrenched suppliers are fighting back with innovations of their own.

Western Union has today introduced its EDGE digital business to business platform for cross border payments between merchants. Australia and New Zealand are two of the six international markets (alongside the US, UK, Canada and Singapore) that will from today have access to the platform that allows near real time service in 22 currencies (a further 22 currencies will be added shortly).