Published on the 18/03/2013 | Written by David McNickel

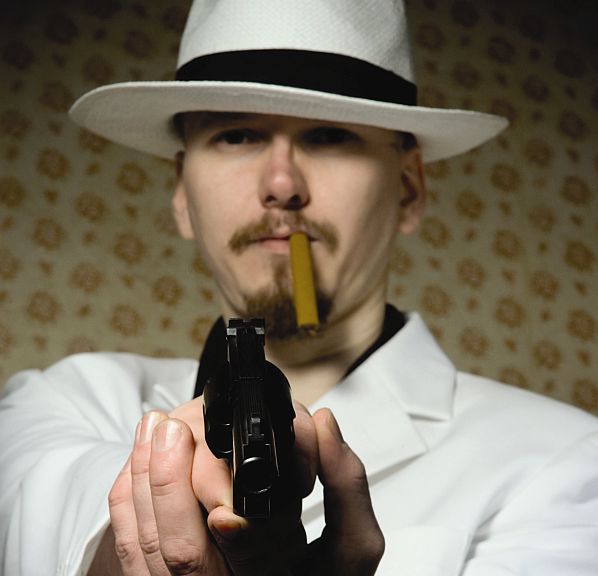

We feel like we are being held to ransom by our invoicing, but if we don’t get the dollars in the door more easily and effectively, our livelihoods will be on the line…

You haven’t actually made a sale until you’ve been paid. It’s as simple as that, but, as blunt as it sounds, it doesn’t actually come close to detailing the true ramifications of not being paid on time. No, the mob is not going to come a-knocking, but the fact is that if you haven’t been paid then your outstanding invoices are costing you money – so much that you may as well be paying interest on a loan from a loan shark. At business software experts GlobalBizPro, sales director Grant Harwood drills down to the real cost of late payment. “The biggest thing is the cost of debt collection,” he says. “People underestimate the time and eFfort it takes to do that and they’d be blown away by what it actually costs. Maybe you have to get a new admin person because one of them is spending so much time on debt collection – so there’s another $45,000 salary. Plus there’s the overdraft interest rates at 13 percent – 16 percent and the opportunity cost of a person not working on processing already successfully paid for orders.” Putting all the other aspects of invoicing and collection efficiency aside, executive manager of product at accounting solutions provider BankLink, Dan Carpenter, says that addressing two important parts of the process would pay big dividends for many businesses. “One is around the billing term,” he says. “So many small businesses are still billing on the twentieth of the month, but they could bring that in and have a seven-day turnaround. The second problem is the delay the small business owner has in getting the invoices out. They are a couple of key elements that are so easily fixed for a business.” And this does not just apply to small business. “From our perspective,” says Aaron Baker, at revenue assurance developers Gentrack, “if a large business like a utility can’t get their bills out, they don’t get paid, it’s as simple as that, and that obviously has an impact on what they can reinvest into the business to expand and develop their whole customer relationship.” So, with the downside of slow invoicing and payment now clear, what are the technology options that businesses in the small, medium and enterprise sectors can use to address these issues? Automate the easy stuff “One is really manual,” he says describing a combination of a manual-based cash book – probably a spreadsheet – that business managers download their bank statements into and reconcile (often leading to a bit of a mess) and then hand off to their accountant to tidy up. “At the other end, there’s the small business owner who has bought a genuinely sophisticated accounting system that is far too complex for their needs,” he says. Logic dictates that small business owners should focus on running their businesses and let their accountants handle the accounting. With this in mind BankLink electronically supplies accountants with their client’s transaction data securely from banks, building societies and co-ops. This means accountants no longer have to manually re-key their client’s transactions on the couple of occasions a year when the client gets their paperwork together. Further to this, accountants can also keep a closer eye on their client’s cash flows. “Accountants usually know their client’s businesses really well,” says Carpenter, “so if they see some important transactions haven’t appeared, all they have to do is pick up the phone or fire off an email saying ‘hey I’m concerned about that number’ or ‘this doesn’t look right’. They can be more proactive about assisting clients in managing their cash flow.” Carpenter points out that there is a difference between a small business like a plumber or a lawn mower man, who have relatively consistent income and expenses and aren’t planning to expand, and entrepreneurs, who are more likely to want their business to grow. “As they [entrepreneurs] start out, BankLink is really useful and relevant to them, but they may get to a stage where they want a more complex solution. We also support solutions in that space, supplying data to products like MYOB Live Accounts and AccountRight.” In terms of workload reduction for the small business operator who wants to ease their bookkeeping burden, Carpenter points to Auckland vet Alex Melrose as a good case in point. Prior to BankLink, Melrose says he was spending hours every month on bookwork, sending his accountant paper bank statements and searching through records for receipts. With BankLink, however, he says his accountant is now able to provide a monthly profit and loss report that he uses to compare against his operating budgets, and his manual bookwork has decreased dramatically. “It now only takes me 30 minutes a month,” he says. “By using BankLink my time spent on bookwork has been reduced by 90 percent.” Carpenter says BankLink currently processes transactions on behalf of more than 210,000 bank accounts in New Zealand and more than 280,000 in Australia, servicing more than 5000 accounting practises. For clients who want to get some added value out of their invoicing, he says many install BankLink’s InvoicePlus, which, in addition to creating professional-looking invoices, enables users to issue quotes, produce statements and run reports. Another company offering a new take on invoicing is Xero. Although the launch of its Online Invoicing service last October met with something of a user backlash due to a perception that Xero was encroaching on the supplier/customer relationship, the foundation principle is solid. With Online Invoicing, a business can email its customers a link to a live invoice, which features a ‘pay now’ button through which clients can choose to pay immediately. Invoices can be automatically loaded into Xero and matched against bank receipts, eliminating manual file uploads and saving data entry time. Facilitate, integrate and automate Asked for advice as to whether a company should sell online or not, Harwood says if you can Google your product type and find someone else is selling it online, then you should seriously consider doing the same. And, from a cash flow perspective, an online sale has immediate benefits over a sale where invoices are mailed out and you wait patiently for payment sometime over the next couple of months. “It addresses a hidden trap in the sales process,” he says, explaining that when somebody makes a buying decision online “they are at the peak of acceptance for their decision”. In an online scenario the payment is processed there and then but when invoices are dispatched and payment is delayed buyer’s remorse can set in. “As time goes by they start to question the money out of their pocket versus the benefits they had in mind when they were making that purchase decision online. So the longer we leave the money in their pocket, the greater the percentage of them that will bail on the sale,” he explains. Adding an online payment system can have a dramatic effect. Harwood points to the example of a wholesaler client who is now expanding its footprint and improving its cash flows with the addition of a web-store “They can now retail direct to the public at full retail price and a higher margin, plus they can still supply their wholesale customers through a login.” Interestingly, perhaps the biggest surprise for the wholesaler was the speed at which consumers and existing clients alike embraced the system. “They did $500-worth of sales within the first day, before they had even launched out to their database,” says Harwood. “They thought they would have to educate each customer on how to use the website but when the launch went out people didn’t ring up and ask how to use it, they just logged on, purchased and got on with their business. They were surprised about the lack of support and education required by users.” In terms of lowering the cost of sale, the ability to easily integrate e-commerce solutions and accounting packages has also been a game changer in recent years. GlobalBizPro specialises in integrating the open source Magento web-store with MYOB’s EXO enterprise resource management solution – an integration that by its very nature delivers automation and what Harwood describes as the “one touch” promise. “We see it every day where a company has been sold a nice website with an e-commerce portal and they have a totally disparate accounting system with another set of human beings running that part of the business, and yet they are exactly the same thing really.” He also adds that you shouldn’t ignore the role the accounting system plays in the purchasing, stocking, merchandising and warehousing of your product. All you need do is enter a product into your accounting system once and let the integration between that and your e-commerce solution handle the rest. “The reason it’s so affordable is it’s basically just mapping the fields in a particular way. So the price from your accounting system matches the price from your website and the quantity in your accounting system matches the quantity in your website. That’s the beauty of having a computer do it. Let automation do the repetitive tasks for you for the cost of your processing power, which is minimal.” Integration of the accounting system and the web-store can also reduce customer churn as it easily enables client-specific pricing. “In the accounting system you set up a new customer,” says Harwood, “with A-grade pricing, so maybe 10 percent off this range and 50 percent off that range. Once they’re set up like that they can log into the website and see pricing that is specific to them.” The net result, he says, is clients aren’t calling up sales reps asking ‘what’s my price?’ and are also less likely to shop around for a product because they know they’re always seeing their best price when they interact with your company. Know where your customers play – and how they want to pay “Printed bills get lost,” he says. “There was a survey in Australia a while ago where they said 25 percent of households don’t pay their bills simply because they’ve lost them.” Utilities are hurrying to move to e-billing as a result, he says, as an emailed bill is much less likely to get misplaced in a paper shuffle. Interestingly, Baker notes that probably the main driver of efficiencies in large-scale billing scenarios at utilities is the arrival of ‘big data’ and the ability that has given suppliers to understand their customers better. “Utilities are starting to deal with ‘real’ customers,” he says, “whereas traditionally they have dealt with meters or properties. Now that the CRM tools are in place these utilities have an opportunity to understand Mr & Mrs Smith rather than property 18 Johnson St, which is key to ensuring you can bill them correctly and that you get paid on time – it’s all interrelated. Another potential spanner in the works for efficient collection is customers not understanding their bills or seasonal price fluctuations – something Red Energy has addressed with its Even Pay service, which averages out the customer’s bills so they pay the same amount every billing round, and can choose their payment dates to match their pay cycle. Again, Baker points out, big data and the capacity of modern CRM systems to store many layers of customer information has empowered this type of client customisation. “We’ve seen a real evolution of the processing power of data management tools in the last four or five years,” he says. “Best-of-breed billing systems are integrating with CRM and metadata management. They’re talking to each other and they’re also talking with new payment gateways and self-service portals.” One result of this automation and the move to faster processing is that customers are now being invoiced in ‘real time’, instead of being batched processed at night or the end of the week. “The customers end up getting their bills more quickly,” says Baker, “and they’re also given access to tools to pay those bills more rapidly as well. So the whole streamlining of the data and provisioning across all of those core components has definitely improved the whole meter-to-cash process.” With cheques having gone the way of the dinosaur Baker says in order to get paid promptly, businesses must play where their customers play. Thus, online payment portals, traditional mail, smart applications on mobile devices and standard telephone interaction are all options. And additionally he says many businesses are also using social media-esque channels to interact with customers, with web chat facilities in call centres enabling customer service reps to engage with several customers at once, lowering the all-important ‘cost to serve’. “Businesses are leveraging more automated tools for getting data and information services out to customers and dollars through the door,” he says, “and the more they can streamline that, and lower the overall cost to serve, the more they can focus on other areas of their business.” There have never been more ways to get the dollars in the door as there are today, but without integration and automation we may as well revert to shoebox accounting. …

According to a business demographics survey released by Statistics NZ in February 2012, of New Zealand’s 469,118 businesses, 69 percent had zero employees (sole traders) and a further 21 percent had only one to five employees (a plumber with an assistant for example). At BankLink, Carpenter says two methods dominate how businesses in this sector have typically managed their accounts, and neither is particularly good for monitoring cash flow.

For the small-ish to medium-sized enterprise, especially those with the potential to sell via a website, GlobalBizPro’s Harwood says the set-up costs for e-tailing have plummeted in recent years and clients that previously couldn’t justify a spend of $40,000 – $50,000 on a bespoke e-commerce platform, can now purchase similar functionality for as little as $1000 and a monthly charge of $99.

Although we might imagine large energy retailers like Genesis in New Zealand or Red Energy in Australia as the definition of the phrase ‘cash cow’, the fact is that when you have hundreds of thousands of customers, it’s harder to get paid than you think. One logjam to payment, says Gentrack’s Baker, is actually the traditional mailed bill.