Published on the 10/11/2020 | Written by Heather Wright

Inaugural report lays out finance sector’s plans…

There’s plenty of appetite for open banking, the Consumer Data Right and the new opportunities they bring, but don’t expect to be seeing big returns from the new regime in the near future.

Open banking moved into phase two this month in Australia, with home loan and mortgage offset data from ANZ, CBA, NAB and Westpac now added to the mix.

But there’s still much to be done before the open banking ecosystem lives up to its promise of being a ‘game changer’ for the sector, according to the inaugural State of Open Banking in Australia report.

“First movers will have a real competitive advantage and will put pressure on the rest of the industry to invest in catching up.”

The report, from fintech Frollo and technology provider NextGen.Net, is based on interviews with key industry leaders and a survey of 161 finance and banking professionals across Australia, and paints a picture of a sector keen to harness CDR, but wary of major challenges ahead.

The findings come as New Zealand too looks to liberate user data. While New Zealand’s efforts have been moving at glacial pace, slowed even further by Covid-19, consultation on a national consumer data right began in August, a year after CDR legislation was passed by Australian parliament. Submissions on the Ministry of Business, Innovation and Employment’s discussion document closed in late October.

FintechNZ chief executive James Brown says New Zealand has the opportunity to learn from Australia – something he says could lead to a trans-Tasman open banking joint project.

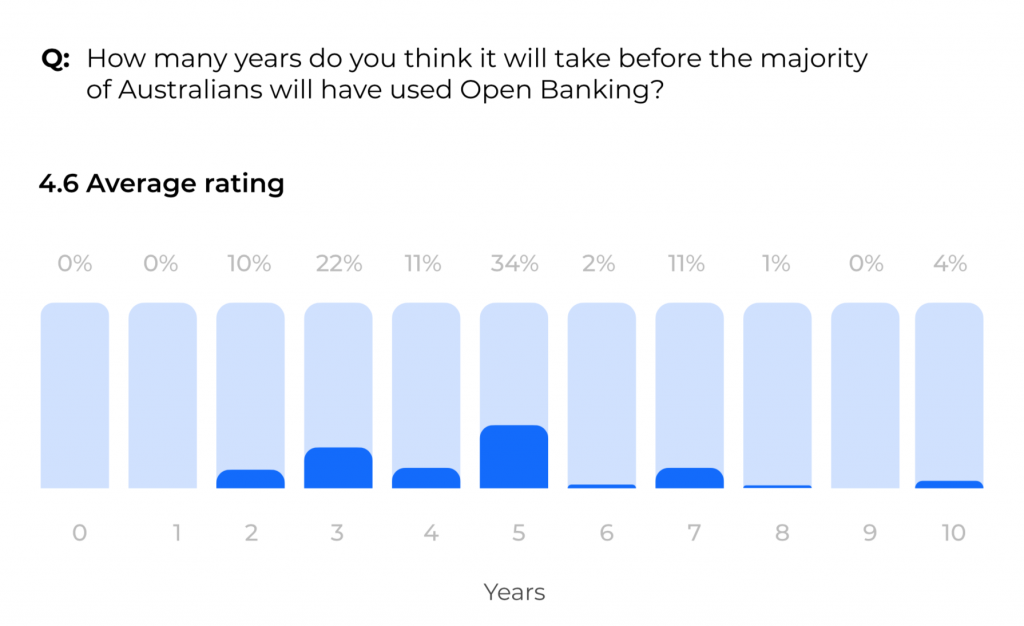

But back to the State of Open Banking report: It shows 71 percent of industry respondents intend to use CDR data, with 45 percent planning to do so within the next 12 months. However, the general feeling among respondents was that it will take three to five years to gain momentum, with complexity and uncertainty, along with a lack of consumer understanding, causing concern.

Gareth Gumbley, Frollo CEO and founder, says while the rollout was on track, the research revealed the biggest challenge for organisations was a lack of clarity around what it takes to become involved in the CDR in terms of costs and return on investment.

“We know that change at this scale doesn’t happen at the flick of a switch, but as it stands there is too much ambiguity. The rules aren’t clear and for many it’s perceived as a mountain too big to climb. There’s a difference between consultation and collaboration. Now is the time for the regulator to invest in a simpler and more flexible framework to speed up adoption, or empower banks and fintechs to innovate and get on with it for the benefit of everyone else who will follow,” he says.

Despite that, organisations are prepared to put their money where their mouth is, with most survey respondents saying they’re investing in open banking over the next 12 months. As to how much they’re investing, the majority expect to spend up to $500,000 in the next 12 months. Banks skewed higher, with 72 percent saying they’d spend more than $500,000, while 55 percent of technology providers and 54 percent of fintechs saying the same.

Customer satisfaction (65 percent), acquisition (58 percent) and retention (49 percent) were the most important KPIs for CDR investment, followed by compliance (44 percent) and operational savings (37 percent).

Improving customer experience was also the primary driver behind the investments, at 64 percent, followed by product innovation (56 percent) and meeting shifting customer demands (40 percent). Optimising processes and compliance rounded out the top five.

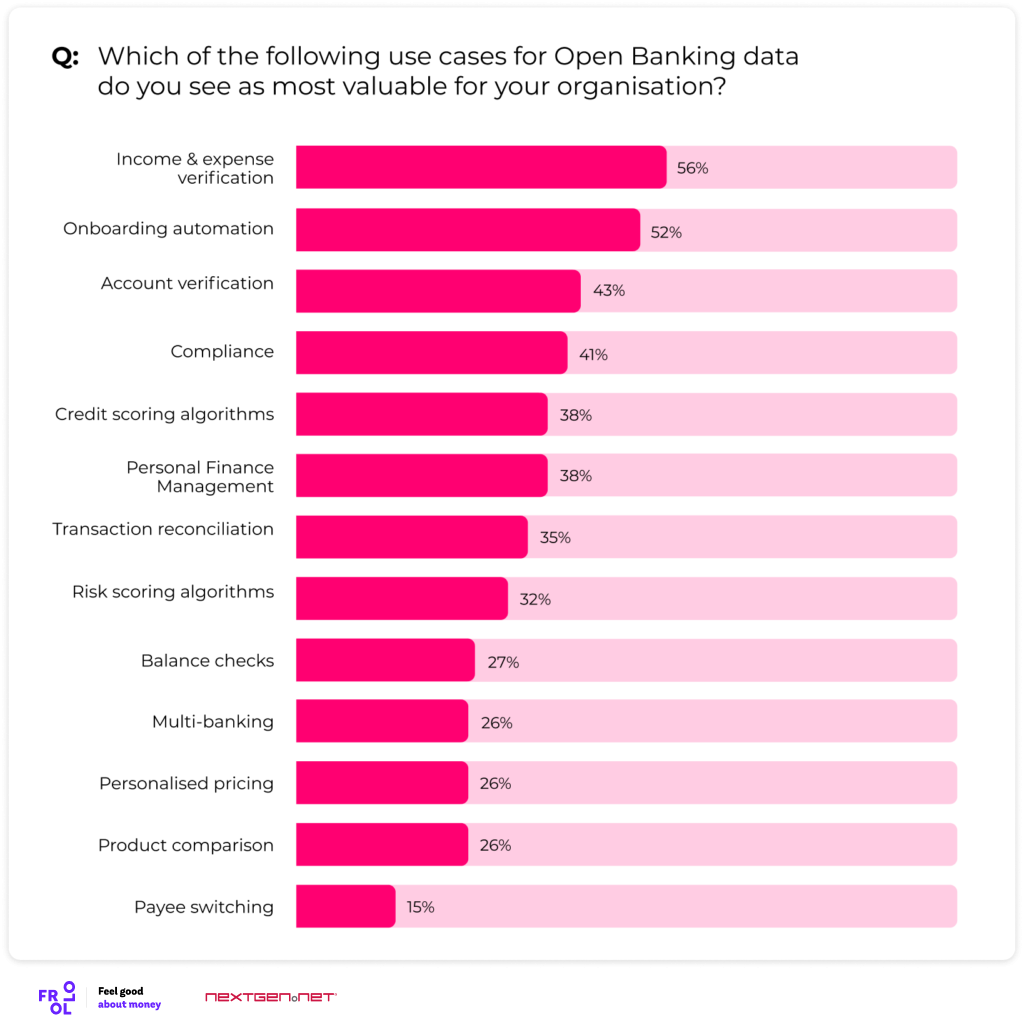

As to what use cases respondents saw as most valuable for their organisations, income and expense verification lead the way (56 percent), narrowly beating out onboarding automation (52 percent), with account verification, compliance, credit scoring algorithms and personal finance management, following.

And while banking data is most in demand – unsurprisingly for a survey of the finance sector – they’re also eyeing up the use of telco and energy data.

“The consensus amongst industry leaders is that first movers will have a real competitive advantage and by offering a superior user experience, they will put pressure on the rest of the industry to invest in catching up,” the report notes. “However, most respondents believe it will take between three and five years before the majority of Australians use open banking.”