Published on the 16/06/2021 | Written by Zag

AT A GLANCE

INDUSTRY

- Central Government

BUSINESS OBJECTIVE

- Find a payroll solution that would deliver robust payroll and HR processes

- Eliminate the need for third-party engagement in remediation

- Maintain their ability to handle payroll processing internally, rather than shifting to an outsourcing model

SOLUTION

- SuccessFactors Employee Central Payroll module

BUSINESS BENEFITS

- HR and Payroll processes

- Additional Employee Central HR processes

- An integration catalogue, including integration with non-SAP systems

- Programme and cutover management

FOR MORE INFORMATION

Zag

NZ: w// zag.team

E: info@zag.team

AU: w// zag.team

E: info@zag.team

Auckland

T: +64 9 571 7100

Wellington

T: +64 4 472 1897

Sydney

T: +61 2 8520 3797

Verdict: Full compliance, smoother pay runs and reduced admin…

New Zealand’s Ministry of Justice becomes the first government organisation to go live on SAP SuccessFactors Payroll, leading the charge on addressing compliance with the Holidays Act (2003) with the help of selected partner, Zag.

Despite best intentions, many New Zealand organisations are not meeting their obligations under the Holidays Act (2003) due to prior misinterpretation of the legislation and the inability to achieve compliance with legacy payroll systems. Now, years on from when the issue was first brought to light, businesses are facing growing pressure to be compliant and remediate all non-compliance. This is proving a significant exercise for those who do not have the modern localised payroll systems and skills to support their efforts.

“There are further strategic opportunities for the Ministry to pick up on when we’re ready.”

New Zealand’s Ministry of Justice (the Ministry) was one of the many organisations that needed a compliant payroll system and needed it fast.

As part of the executive branch of the New Zealand Government, the Ministry works towards a safe and just New Zealand. A key role for the Ministry is providing services necessary to operate the New Zealand court system and to support independent judicial decision-making.

The Ministry’s former payroll system had resulted in both historic and ongoing errors in payments and entitlements for annual holidays, bereavement leave, alternative holidays, public holidays, and sick leave. To put these errors right, the Ministry engaged a third party to calculate and make remediation repayments.

Relying on a legacy system from 1997 was no longer an option.

Procuring a new payroll solution

The Ministry put out a Request for Proposal (RFP) to find a payroll solution that would deliver robust payroll and HR processes, eliminate the need for third-party engagement in remediation and would maintain their ability to handle payroll processing internally, rather than shifting to an outsourcing model.

The solution needs to:

- Support the Ministry’s full compliance with the Holidays Act 2003 and all other relevant laws and legislation

- Accommodate circa 4,500 payees; including the Judiciary and statutory officials (two payroll runs)

- Support multiple employment agreements and remuneration arrangements with varying terms and conditions, work patterns and pay cycles with their own set of accounts

- Be delivered as a service on a subscription basis providing the ability to dial-up or down the subscription as the Ministry evolves.

The Ministry’s Chief Financial Officer (CFO), Andy Fulbrook, says that while the shift from a 20-year-old payroll system to a modern one was sure to provide benefits, they remained clearly focused on the need for compliance with the Holidays Act. “Once it became clear that our practices were not compliant, we knew we needed to look at all three core aspects: policies, procedures and our systems. The focus has always been there.”

Throughout the RFP process, the Ministry also identified other key considerations for choosing a solution. Deputy CFO, Tracey Crowther, says the final decision came down to several factors. “We really wanted an out-of-the-box solution that fitted with our business needs and requirements, without us going down a path of additional customisation.”

Project Manager, Rebecca Ngarimu, adds that they also had an eye to the future. “Obviously the need to achieve compliance was driving the solution procurement but we were aware that the Holidays Act could change in the future and we needed to ensure that if it did, we were working with a partner with a good understanding of legislation and the ability to translate that to the solution to maintain compliance.”

Crowther says that ultimately, after what was a significant tendering process, the Ministry had the most confidence in Zag’s ability to implement and support a compliant payroll solution.

Integrated and localised cloud payroll

The solution proposed by Zag was SAP SuccessFactors, a comprehensive cloud-based Human Experience Management platform that could satisfy the Ministry’s immediate HR and payroll needs with the flexibility and modularity to cater to future workforce requirements.

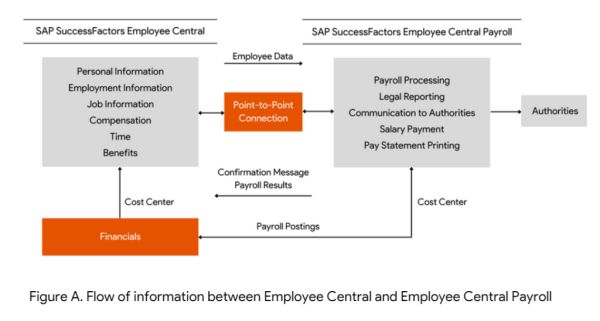

The SuccessFactors Employee Central Payroll module combines proven SAP payroll technology with the latest innovations and service delivery. This enables users to automate and accelerate payroll processing, reduce errors and simplify payroll management. SuccessFactors Employee Central was also proposed due to its ability to provide comprehensive integrated core HR capabilities including Master Data Management, HR Workflow Automation and Position Management.

In short, SuccessFactors Employee Central Payroll addresses compliance while Employee Central delivers the key HR process and information required for that payroll to run.

Designing and implementing for compliance

The implementation followed Zag’s Delivery Framework, based on SAP’s Activate Methodology that comes equipped with best practice approaches, pre-configured business processes, documentation collateral and learnings. It follows four key delivery phases; Prepare, Explore, Realise and Deploy.

Zag’s framework involves closer involvement with the customer, including more onsite support and collaboration than the standard SAP methodology. In the Ministry’s case this was vital, “The Ministry was new to SAP; we didn’t know the system, so we were relying on Zag to bring and transfer that knowledge,” says Ngarimu.

As the solution implementer, Zag delivered:

- HR processes (based on SuccessFactors Best Practices for Employee Central),

- Payroll processes (based on SuccessFactors Best Practices for Employee Central Payroll)

- Additional Employee Central HR processes (deltas to Best Practice)

- An integration catalogue (including integration with non-SAP systems, using SAP Cloud Platform Integration)

- Testing services (strategy, planning, execution & management)

- Data migration (4,500 employees-worth of data)

- Programme and cutover management

Zag kept to SAP standards and best practices, including deploying the standard NZ SAP Payroll set up and delivering point-to-point integration between Employee Central and Employee Central Payroll. In only a few circumstances was it required to deviate from standards to ensure compliance. The main example of this is how Annual Leave is delivered. Typically, the SAP standard leave is done in hours or days but to be compliant with the Holidays Act, Annual Leave needs to be delivered in weeks. Leaning on their wider consulting team, Zag provided a small amount of development to ensure Annual Leave was delivered in weeks as required.

Remote delivery

The project started in April 2019 and went live in June 2020, with the national lockdown due to COVID-19 necessitating some delays. Despite this, the project team successfully transitioned to remote working to maintain momentum. “We had the backing from our Senior Execs that this was a very key and important project and therefore needed the resources to keep it going,” says Fulbrook. “Everyone in the project team from the Ministry and Zag pulled together and worked really well to continue delivering critical phases of the project remotely, including the second dress rehearsal.”

Testing for compliance and usability

Testing was a significant exercise, commencing in November and completed at the end of March. The testing stream had two vital focuses: testing for compliance and, simultaneously, testing an entirely new system against a large number of use cases.

System Testing, System Integration Testing and End-to-End Testing were executed to ensure individual modules function and integrate at a business process level and that the relationship between applications meets known requirements to work as one integrated end-to-end solution for the Ministry.

The Parallel Payroll Test is a key input into the verification that the Employee Central Payroll engine is fit for purpose, legally compliant and delivering to expected outcomes. It highlights differences between how the legacy system calculated payroll elements, compared with how the new solution will calculate these elements. As the Ministry had a third-party system engaged in remediation, there was an added layer of complexity as there was no single source of truth for payroll comparison. Given the need to comply with the Holidays Act, payroll conversion had to result in 100% reconciliation. All the intricacies were tackled and each of these changes were reconciled and proven to be correct.

Zag’s testing team brought deep familiarity with Holidays Act compliance along with more than 50 years of combined experience in SAP Payroll. The preloaded test scripts that Zag provided as part of an acceleration package proved beneficial, as did the fact that Zag’s testing and implementation teams used aligned methodologies. The combined Zag and Ministry’s testing teams were also able to deliver the most crucial phases of testing remotely during the lockdown.

Outcomes and future opportunities

With the switch to SuccessFactors, the Ministry is now delivering correct pay in full compliance with the Holidays Act (2003), and remediation is now being executed from the new system. The solution is also compliant with Government cloud standards.

SuccessFactors offers the Ministry and its staff advantages beyond compliance. Automated processes, workflows and built-in business rules have substantially reduced the paper trail and data entry challenges that occurred with the old system. Crowther says “the workflows are really good, and it’s a big step forward for us as a lot of our processes were done on paper before. The payroll team really like the new system. Pay runs are now smoother, everything is quite instant, and they can make changes and see the results in real-time.”

Staff and managers can access self-service HR functions like timesheets and leave (including via mobile). “All employees can now look at their leave balances on their phone, put in leave requests and managers can approve these requests on their phones too,” says Fulbrook.

“There are further strategic opportunities for the Ministry to pick up on when we’re ready, such as new workflows within the current system and potential deployment of further SuccessFactors modules down the line,” says Ngarimu.

“Knowing that we are looking after our people and complying with the law is the bottom line for us,” says Fulbrook. “It’s an ongoing process for the Ministry getting 4,500 people trained and familiar with the new system, but we are happy to be on a compliant and modern system.”

“We will continue to partner with Zag to support our SuccessFactors system.”

FURTHER READING

About This Vendor

More Case Studies

DOC’s business value with Partner Managed Cloud

Cutting a new track to increased agility and cloud success…

Hydro Tasmania converts to the power of S/4HANA

Remote project delivery mid-pandemic proves a success…

Chorus transforms billing engine

Partnership with Zag delivers a fit-for-purpose billing system, independent from Spark…

Hydro Tasmania’s ‘DIY’ rollout of new mobile asset-inspection software

Australia’s largest water manager liberated by intuitive asset-management app empowering technicians and planners…

Ballance Agri-Nutrients maps path to increased revenue

Driving business performance and sustainability on the connected farm…