Published on the 16/04/2020 | Written by Jonathan Cotton

The data reveals an economy in upheaval…

“When China sneezes, the world catches a cold,” they say, and right now, that’s as true in Australasia as anywhere.

The travel industry is in tatters, no one’s hiring and spending is down, almost across the board. Everyone, everything, everywhere, is affected by Covid-19.

So what’s the damage so far? Official data sources in both Australia and New Zealand are yet to show the impact of the lockdown, but in New Zealand Economist Shamubeel Eaqub from Sense Partners is releasing near-real-time indices of economic indicators. Data from the past week shows:

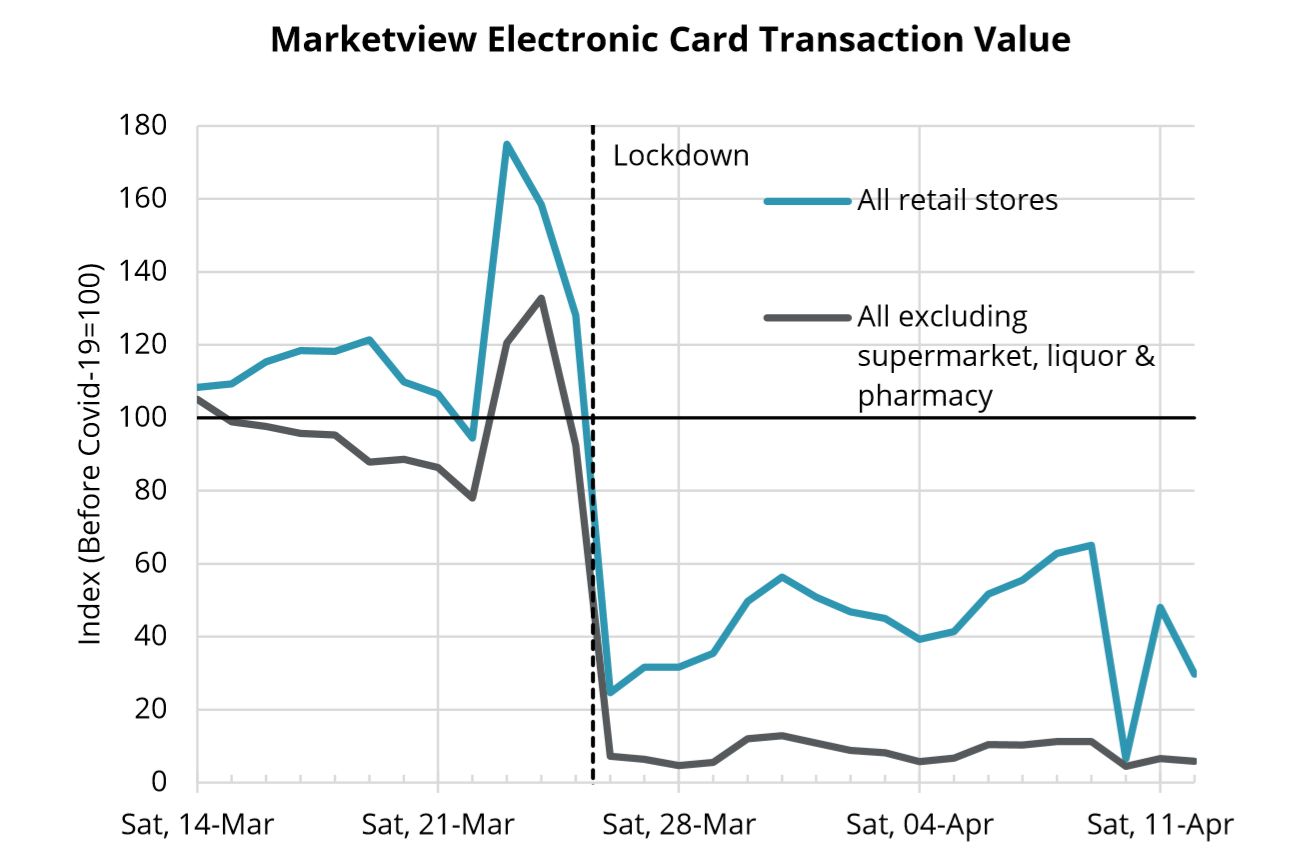

- MarketView analysis of Paymark card spending is down 56 percent from this time last year

- Trade Me job ads are down 68 percent

- Electricity use is down 23 percent

- Tom Tom traffic congestion is down 70 percent

- Number of flights are down 94 percent

Source: http://www.sense.partners/views

Similar real time data is not available for Australia, raising calls from economists at the Committee for Economic Development of Australia for more to be done to make it available.

According to Stats NZ, total retail sales in New Zealand fell NZ$231 million (3.9 percent) for the month of March – their biggest fall on record – with spending on dining and accommodation falling by a third, while grocery stores enjoyed record-high sales, as panic buyers cleared shelves.

Records can be expected to hit all time highs (or lows) when April data is released showing the post-lockdown impact reflected in Eaqub’s analysis.

“Efforts to slow the spread of Covid-19 in the last couple of months led to the closure of all non-essential businesses and people were told to stay at home from midnight March 25,” retail statistics manager Sue Chapman says.

“As paranoia escalated and consumers feared liquor retailers would be next to close, panic buying kicked off.”

“This hit hospitality hard. Restaurants, cafes, and bars, as well as hotels, motels, and other accommodation, saw sales drop sharply.”

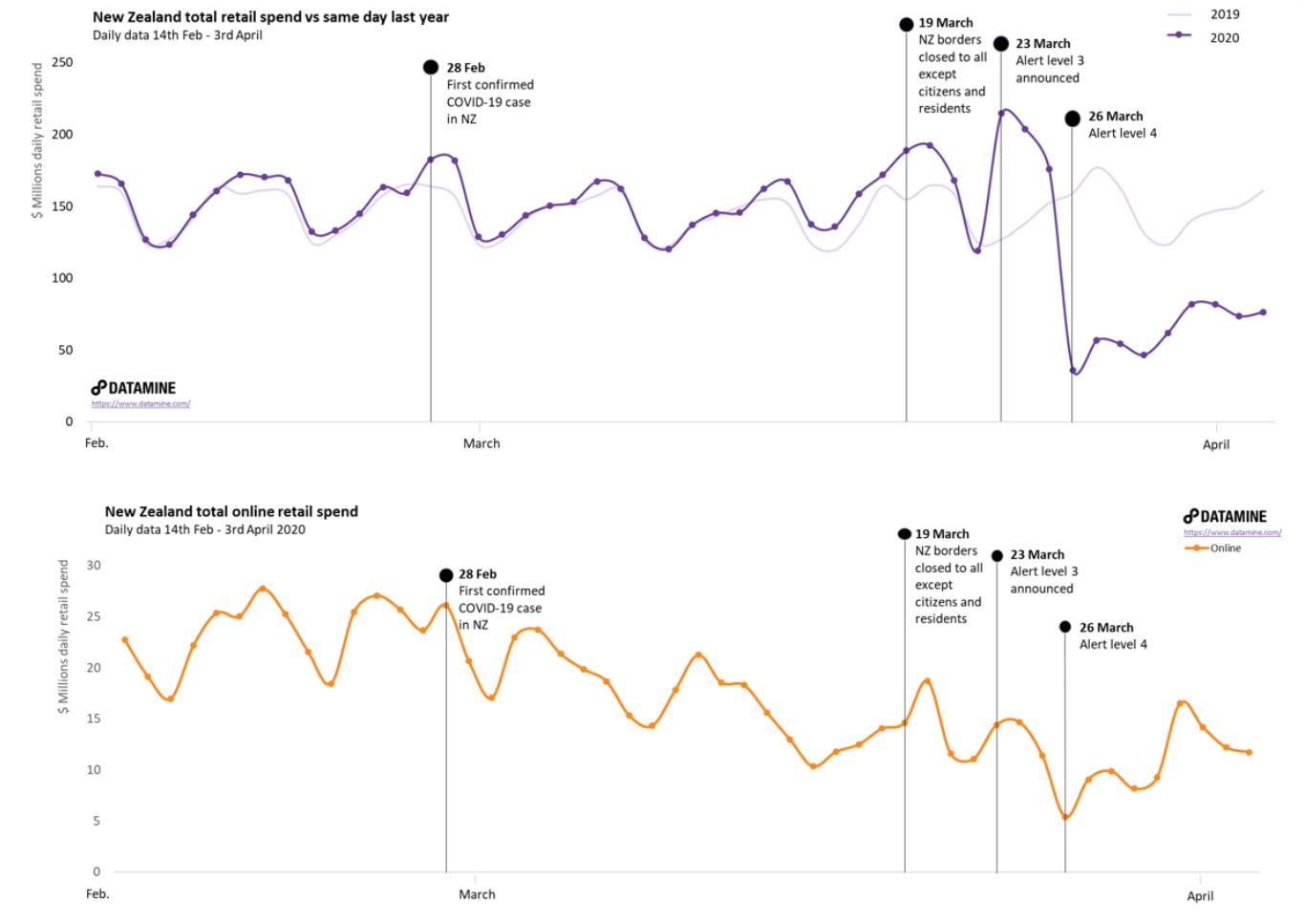

The numbers tell the story from the first waves of panic buying on February 28 – the day New Zealand’s first COVID-19 case was confirmed – to a drastic pre-lockdown increase in spending and subsequent dive to just NZ$36 million (compared to the NZ$160m spent on the same day in 2019) as Alert Level 4 was reached.

It’s a similar story for Australian data with panic buying in the lead up to stricter lockdown measures, if not to the extent as enforced in New Zealand. The disruption from Covid-19 extend an already unsettled period for the Australian economy with the impact of the 2019 bush fires and floods still being felt.

“Ongoing uncertainty has fuelled unparalleled local grocery sales,” says analytics company IRi’s Covid-19: Impact on the Australian FMCG Landscape, which notes similar spending spikes – to the tune of a temporary 84 percent sales growth across grocery retail.

The company uses point-of-sale, loyalty, e-commerce and social media data sources to map changes in consumer and shopper behavior and says that there’s even evidence of panic buying extending to liquor sales.

“As paranoia escalated and consumers feared liquor retailers would be next to close, panic buying kicked off week ending 22nd of March…This saw all states experience beer units sales spike 20 to 45 percent.”

NZ data analytics consultancy Datamine has been tracking year-on-year retail spend changes since the COVID-19 outbreak and says that a lot of the pre-lockdown panic buying was focused on grocery purchases. Daily spending jumped from around $55 million to a $90 million peaks after border closures and lockdown announcements. Official figures show a NZ$376 million (17 percent) jump in grocery shopping.

“As anecdotal evidence suggests, the supermarkets and food retailers category saw extreme increases in spend from mid to late-March, most notably on the day the borders closed and at the beginning of the pre-lockdown panic,” says Datamine.

“Since the pre-lockdown panic, there was a drop in categorical spend compared to the same period last year, followed by an upward trend to end April 3 around NZ$60 million (about NZ$10 million higher than last year).”

“Within this category, we also see what appears to be the most dramatic spike in any of the categories – on March 23, liquor store category spend was around $18 million higher than the day before. This trend continued over the pre-lockdown panic period before immediately dropping down to only about NZ$0.5 million on March 26. Since then, there has been a slight uptick in categorical spend, but as of April 3 is still tracking more than $5 million lower than the same day last year.”

Online spend shows how hard retailers need to work to build e-commerce channels to support the new world order. Online grocery sales account for around 10 percent of the total, and the peak of $6.4 million daily sales was accompanied with widespread complaints of long delivery lead times as e-commerce supply chains struggled to meet demand.

Of interest will be how quickly overall sales online will lift once Level 4 restrictions are lifted and NZ retailers, including food outlets, are allowed contactless trading under Level 3, which will likely kick in from next Thursday (23 April).

For data sources refer https://www.datamine.com/reports/retailwatch/covid-19-special

Of all industries, travel and accommodation is surely one of the hardest hit. Total visitor arrivals fell steeply in February 2020, down 45,200 (11 percent) to 372,700 when compared with 2019 – the biggest drop in arrival numbers for any February month on record, says Stats NZ.

Commercial air traffic continues to fall of course, with international arrivals now down 99 percent compared with 2019. International departures are down 95 percent on last year.

Before the travel restrictions were imposed, China had been New Zealand’s second-largest source of visitor arrivals on an annual basis, behind Australia. Similarly, the number of international student arrivals is down. The total number of arrivals on student visas fell by 29 percent to 15,000 in February 2020 compared with 2019.

“We begin to see a much more significant drop around the beginning of March, with a steady decline in spend until the end of the month,” says Datamine.

“On April 2 of last year, the travel and accommodation industry saw spend levels of over $12 million – the same day in 2020 saw spend of -$900,000.”

So what does it mean for the future?

“Australia was already confronting economic headwinds that were going to impinge on consumer spending in the new decade,” says IRi. “The coronavirus outbreak has amplified the risk of a recession locally and globally in 2020 because the actions to limit Covid-19 spread will curb overall spending.”

“That said, the prospect of deeper isolation through lockdowns creates new unknowns.”

A recent Auckland Chamber of Commerce survey of 1000 Auckland businesses finds that 30 percent are not confident they will survive the Covid-19 pandemic. Around 80 percent of New Zealand businesses have applied for the Government wage subsidy, with nine percent having made employees redundant because of the pandemic.

For now, the Government is warning to expect the worst.

“The severity of the downturn will depend on many factors, including our success in eradicating Covid-19, how long the lockdown lasts and what restrictions remain in place beyond the lockdown period and for how long.

“We expect business conditions to remain negative for much of 2020, and into 2021 for some sectors.”