Published on the 05/03/2018 | Written by Jonathan Cotton

Disruption is, by its very nature, unpredictable, right? Well, not so fast. According to Accenture, that ain’t necessarily so…

A new study from the professional services company looking at industry disruption asserts that, rather than being ‘random’ and, therefore, beyond business leaders’ control, disruption actually has a pattern that can be identified, understood and prepared for.

“Disruption is continual and inevitable – but it’s also predictable,” says Omar Abbosh, Accenture’s chief strategy officer.

“Business leaders need to determine where their company is positioned in this disruption landscape and the likely speed of change. The more clearly they see what’s changing around them, the better they can predict and identify opportunities to create value from innovation for their business and rotate to the ‘new’.”

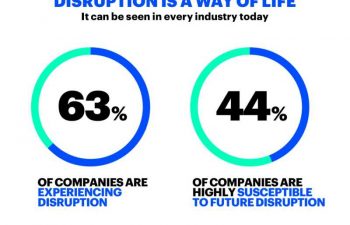

The study analysed the circumstances of 3,600+ companies with annual revenues of at least US$100 million. According to the report, almost two-thirds (63 percent) of companies currently face “high levels of disruption”, and two-fifths (44 percent) show “severe signs of susceptibility to future disruption”.

With few things certain, disruption, it seems, may be the only constant. No surprises there, but more curious is Accenture’s assertion that this disruption is, in fact, quite predictable – if you know what to look for.

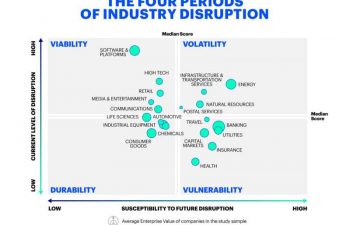

To that end Accenture has created something it calls the ‘Disruptability Index’. By dissecting disruption into its key components – the presence and market penetration of disruptor companies as well as incumbents’ financial performance, operational efficiency, commitment to innovation and “defenses against attack” – business leaders can, in theory at least, identify risks and opportunities, and presumably prepare their strategic response.

So what’s the lay of the land then? Which industries can look forward to business-as-usual and who’s staring down an uncertain future?

According to Accenture, automotive retail and supply, alcoholic beverage and diversified chemicals industries fall into the ‘Durable’ category. Disruption is evident but not life-threatening, incumbents still enjoy structural advantages and deliver consistent performance. About one-fifth of companies fall into this category.

The ‘Vulnerable’ category – where disruption is moderate, but incumbents are susceptible to future disruption (due to, say, structural productivity challenges such as high labor costs for example) – is occupied by such industries as insurance and healthcare and the convenience retail sector.

Consumer technology, diversified banking, advertising and transportation services industries occupy the ‘Volatile’ category. Inhabited by violent, sudden disruption, in this category traditional strengths have become weaknesses. 25 percent of companies occupy this space.

Finally, in the ‘Viable’ category disruption is a constant. Sources of competitive advantage are often short-lived, as new disruptors consistently emerge. More than one-third (37 percent) of companies – including software and platform providers; telecommunications, media and high-tech companies; and automotive manufacturers – fall into this group.

“To not only survive disruption but thrive when it strikes requires companies to transform and grow their core business while simultaneously innovating to create and scale new businesses,” says Mike Sutcliff, group chief executive of Accenture Digital.

“Embracing digital is crucial part of it. We found that the lower an industry’s digital performance, the more susceptible it is to future disruption. Digital technologies can help make a company more resilient in times of disruption in a number of ways, whether by driving better outcomes from existing products, developing entirely new digital services, lowering costs, or increasing barriers to entry.”

While unlikely a magic bullet for dealing with every industry uncertainty, the index is, in principle at least, an example of the right kind of thinking: Better to be preparing for change – even if you’re off the mark – than fearing the future, right?

For more on the 20 industry sectors and 98 sub-segments that Accenture applies the index to – and strategies for dealing with your position on the Disruptability Index – see chief strategy officer Omar Abbosh’s blog, Disruption Need Not be an Enigma.